- Bitcoin is approaching the $50,000 level, but Cathie Wood’s Ark Invest says the hype “seems contained.”

- “We believe the different search dynamics suggest that institutions could be the incremental force behind bitcoin,” Ark Invest said in a note on Monday.

- Bitcoin leaped to all-time-highs on Monday after Tesla said it purchased $1.5 billion of the cryptocurrency.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin soared 20% over the past two days and is approaching the $50,000 level after Tesla disclosed that it purchased $1.5 billion of the cryptocurrency in January and plans to begin accepting it as a form of payment for its products soon.

But despite the record surge, the hype in bitcoin “seems contained,” Cathie Wood’s Ark Invest said in a note on Monday.

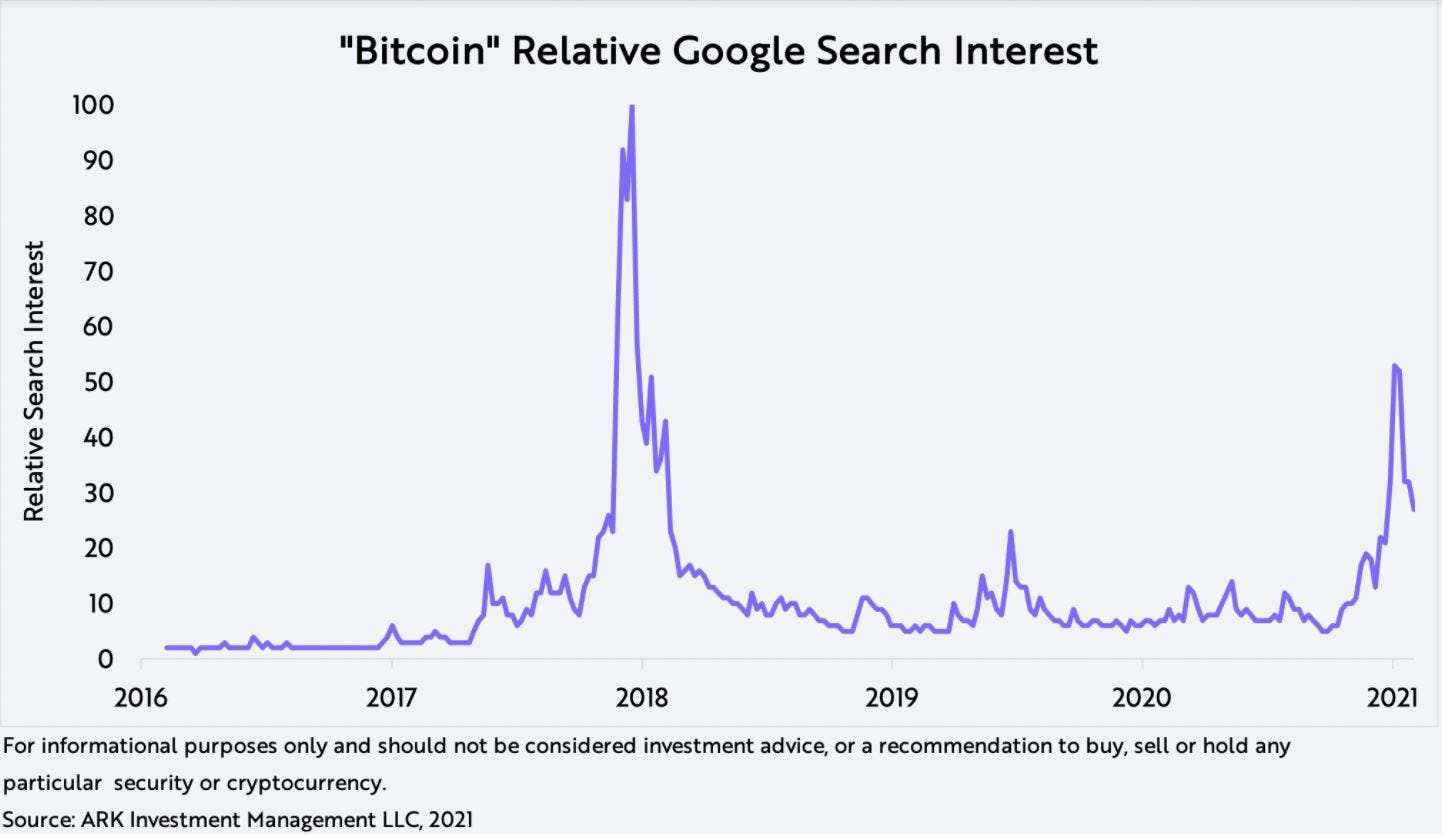

That conclusion is based on the fact that Google Search Trends for ‘bitcoin’ are still significantly below levels seen in December 2017 when bitcoin hit a high of nearly $20,000.

In early January, the search activity for bitcoin reached only 50% of the peak in 2017, and has since dropped 25%.

The reduced search activity suggests that institutions are driving the recent demand for bitcoin, rather than retail investors, according to the note.

"We believe the different search dynamics suggest that institutions could be the incremental force behind bitcoin," Ark Invest said.

Retail investors are instead focusing their attention on ethereum, which soared to an all-time-high of $1,825 on Tuesday. According to Ark Invest, Google search activity for 'ethereum' have surpassed the 2017 highs.

Finally, a recent MicroStrategy conference for institutional investors "could support the same conclusion" that demand for bitcoin is being driven by professional investors rather than retail investors, Ark Invest said.